mortgage refinance transfer taxes

You pay them upfront to get a lower interest rate during the. Ad There May Never Be a Better Time To Refinance Your Home.

What Are Real Estate Transfer Taxes Forbes Advisor

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands.

. If you paid points when you refinanced your mortgage you may be able to deduct them. 500 2 is 1000 and that would be what you owe in transfer taxes for the sale. Many states charge a feetax when a home is.

In a refinance transaction where property is not. State laws usually describe transfer tax as a set. In this instance the original mortgage recording tax is transferred along with the.

Ad LendingTree Makes Your Mortgage Refinance Search Quick and Easy. Tax deductions and refinancing. Form TP-584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Payment of Estimated Personal Income.

Does not apply to refis just purchased in PA. For example a homeowner who paid 2000 in points on a 30-year mortgage 360 monthly payments could deduct 556 per payment or a total of 6672 for 12 payments. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded.

On an existing home resale it is customary in Maryland for the transfer and recordation taxes to be split evenly between the buyer and seller. If the home buyer is a first. CARROLL COUNTY 410-386-2971 Recordation Tax.

Comparing lenders has never been easier. What Are Mortgage Transfer Taxes. If you sold the property for 250000 you would divide 250000 by 500 which is 500.

30-year fixed-rate refinance falls 009. Mortgage transfer taxes often referred to as mortgage recording taxes are fees imposed by state and local governments whenever you take out a new mortgage. The same rules apply for closing costs on a rental property refinance.

Your lender does not know what they are doing. State Transfer Tax is 05 of transaction amount for all counties. The IRS allows you to deduct the interest paid on up to 1 million in mortgage debt on either your primary or secondary home or the two combined.

For those of you seeking ways to save money on refinancing consider a mortgage assignment. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate. So if you purchase 2000.

A cash-out refinance allows you to borrow from your home equity which is the difference between your current mortgage balance and the total value of your home. 52 rows Mortgage transfer taxes often referred to as mortgage recording taxes are fees. In contrast to a property transfer Maryland State law and the County do not require that property taxes must be paid if you refinance your mortgage.

However you can claim this deduction every year until your loan matures. The State of Delaware transfer tax rate is 250. Ad LendingTree Makes Your Mortgage Refinance Search Quick and Easy.

In some areas in Northern Virginia an additional 015 is charged per. Comparisons Trusted by 45000000. Compare top lenders in 1 place with LendingTree.

Call us for a quote 2675144630 x1. Ad 2021s Trusted Online Mortgage Reviews. Points are prepaid interest.

Delaware DE Transfer Tax. 30-year fixed mortgage rates fell today. The average 30-year fixed-refinance rate is 522 percent down 9 basis points from a week ago.

Comparing lenders has never been easier. The lender will contribute 25 of the mortgage tax. Comparisons Trusted by 45000000.

Ad 2021s Trusted Online Mortgage Reviews. In a nut shell for residential condominiums and 1-3 family homes when the mortgage is less than 500000 the borrowers portion of the. Transfer Tax 10 5 County 5 State Subtract 125 from County Tax if property is owner occupied.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per. For example if you spent. Refinance Property taxes are due in November.

A property selling for. Ad There May Never Be a Better Time To Refinance Your Home. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

A month ago the average rate on a. 13th Sep 2010 0328 am. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of.

Compare top lenders in 1 place with LendingTree. The grantor tax that the state charges the seller is 1 for every 1000 of the sale price or roughly 01. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

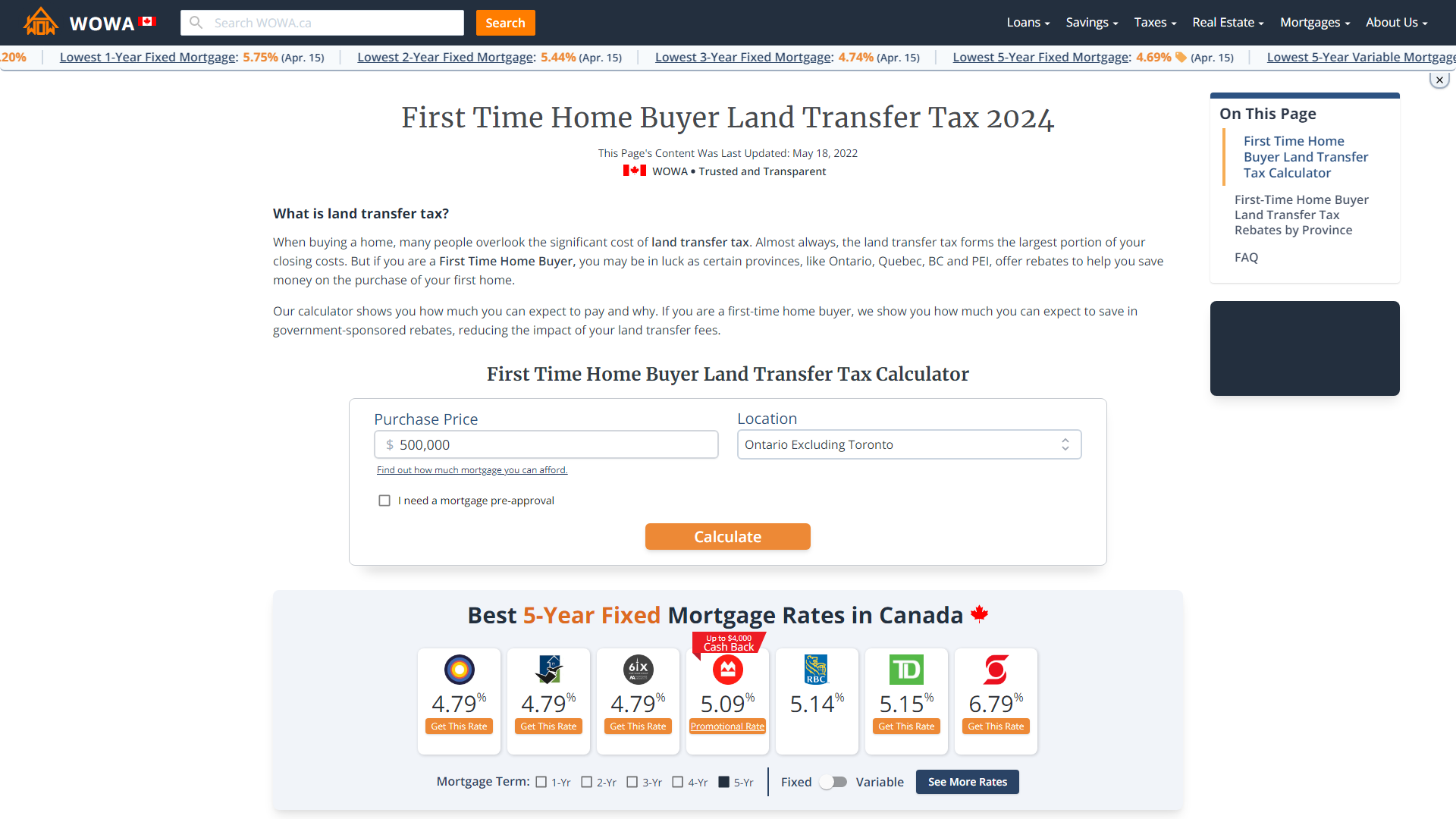

Toronto Land Transfer Tax 2022 Calculator Ratehub Ca

Understanding Mortgage Closing Costs Lendingtree

Refinancing Your House How A Cema Mortgage Can Help

![]()

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Understanding Your Mortgage Payment Nesto Ca

Closing Costs Ontario You Must Know Before Buying Or Selling Property

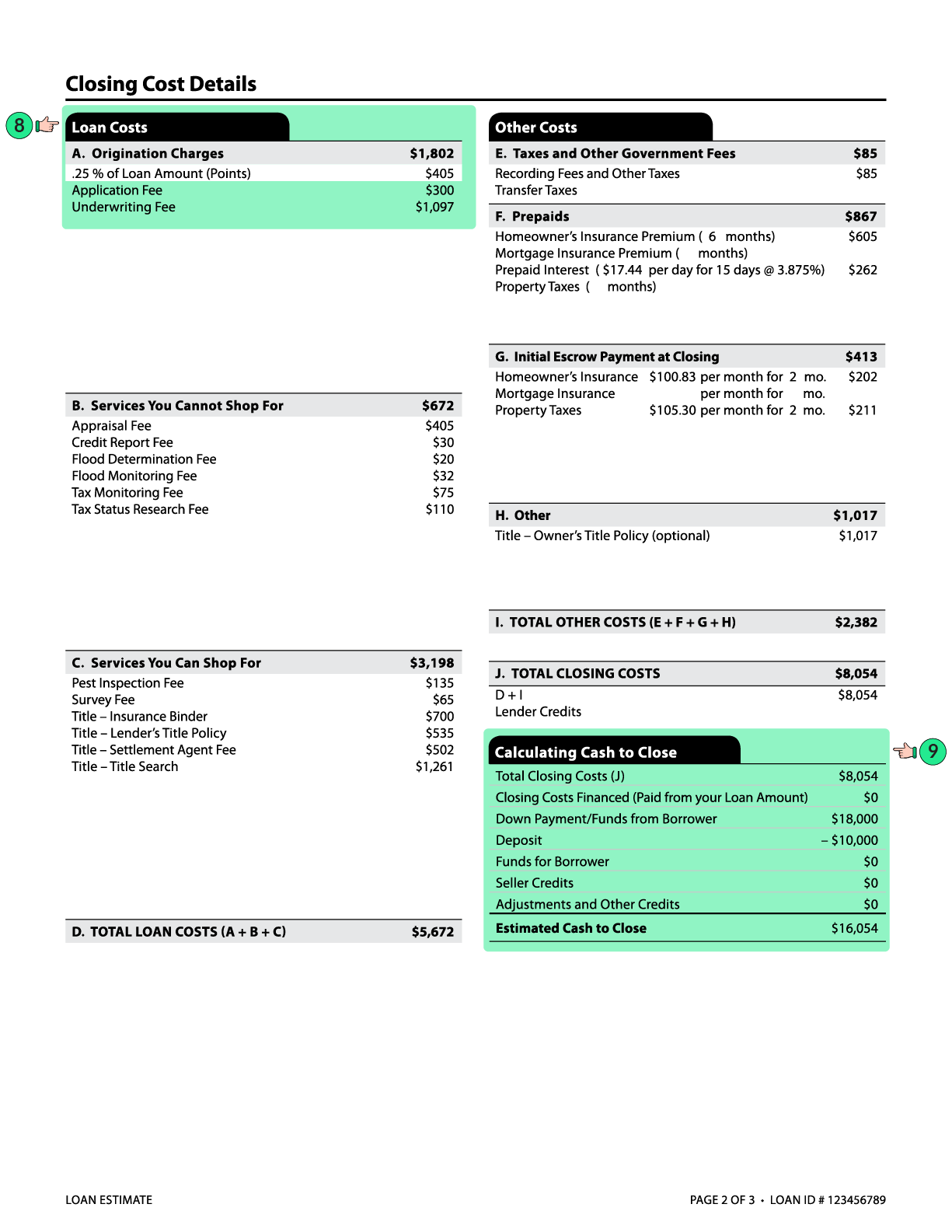

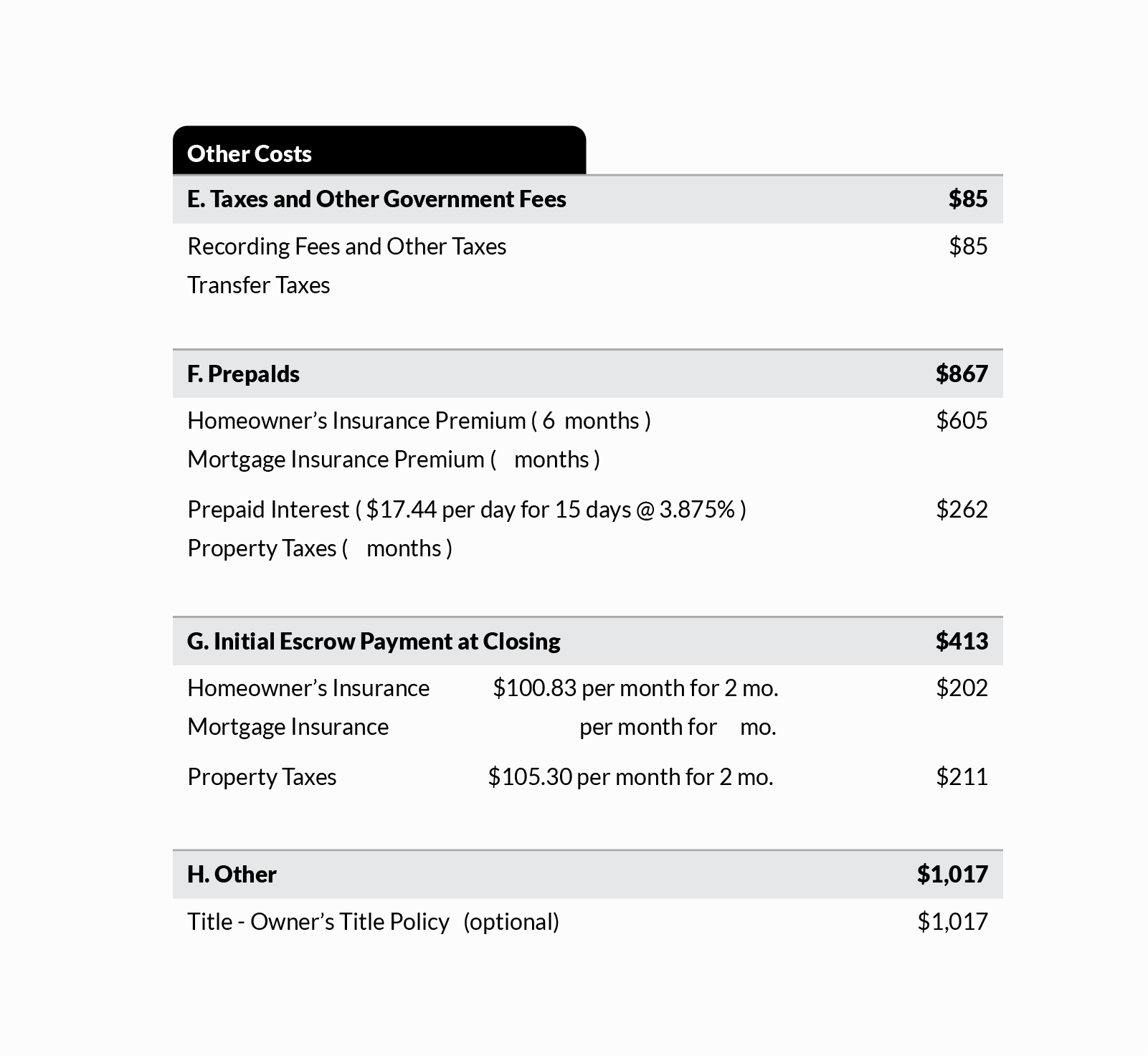

What Is A Loan Estimate How To Read And What To Look For

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

Should You Break Your Mortgage Nesto Ca